The Potential Economic Impacts of Various Debt Ceiling Scenarios

Link to Full Analysis

Summary:

New analyses by both the Congressional Budget Office and the U.S. Department of the Treasury suggest the United States is rapidly approaching the date at which the government can no longer pay its bills, also known as the “X-date.” History is clear that even getting close to a breach of the U.S. debt ceiling could cause significant disruptions to financial markets that would damage the economic conditions faced by households and businesses. Real time data, shown below, indicate that markets are already pricing in political brinkmanship related to Federal government default through higher risk premia.

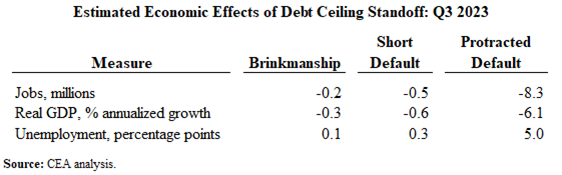

An actual breach of the U.S. debt ceiling would likely cause severe damage to the U.S. economy. Analysis by CEA and outside researchers illustrates that if the U.S. government were to default on its obligations—whether to creditors, contractors, or citizens—the economy would quickly shift into reverse, with the depth of the losses a function of how long the breach lasted. A protracted default would likely lead to severe damage to the economy, with job growth swinging from its current pace of robust gains to losses numbering in the millions.

In other words, defaulting on our government’s debt could reverse the historic economic gains that have been achieved since the president took office: an unemployment rate near a 50-year low, the creation of 12.6 million jobs, and robust consumer spending that has consistently powered a solid, reliable growth engine, supported by paychecks from the strong job market and healthy household balance sheets.

Because the government would be unable to enact counter-cyclical measures in a breach-induced recession, there would be limited policy options to help buffer the impact on households and businesses. The ability of households and businesses, especially small businesses, to borrow through the private sector to offset this economic pain would also be compromised. The risks engendered by the default would cause interest rates to skyrocket, including those on the financial instruments that households and businesses use—Treasury bonds, mortgages, and credit card interest rates.